TSP Weekly Newsletter

TSP Weekly Newsletter

December 17, 2023

The market continues higher on a ton of economic data and an FOMC meeting. For the week the C fund was up 2.49%, S fund up 5.05%, I fund up 1.67%, and F fund up 2.15%. In the short term, the market is clearly in rally mode! The question we need to ask is, what happens in 2024?

No one has a crystal ball and everyone has an opinion. The best we can do as TSP investors is to seek out the most diverse opinions from the most reputable sources. This way we can understand the range of possibilities and be prepared to respond to what the market actually does.

Last week's Newsletter focused on a recent CNBC interview with Tom Lee @FundStrat. Tom is very bullish on 2024 and clearly articulates why in this interview. This week we're taking a close look at a recent interview between Adam Taggart at the YouTube channel Thoughtful Money, and Swiss financier Felix Zulauf. Felix has a very different take on price action in 2024 versus Tom. Here's his bio from Wikipedia:

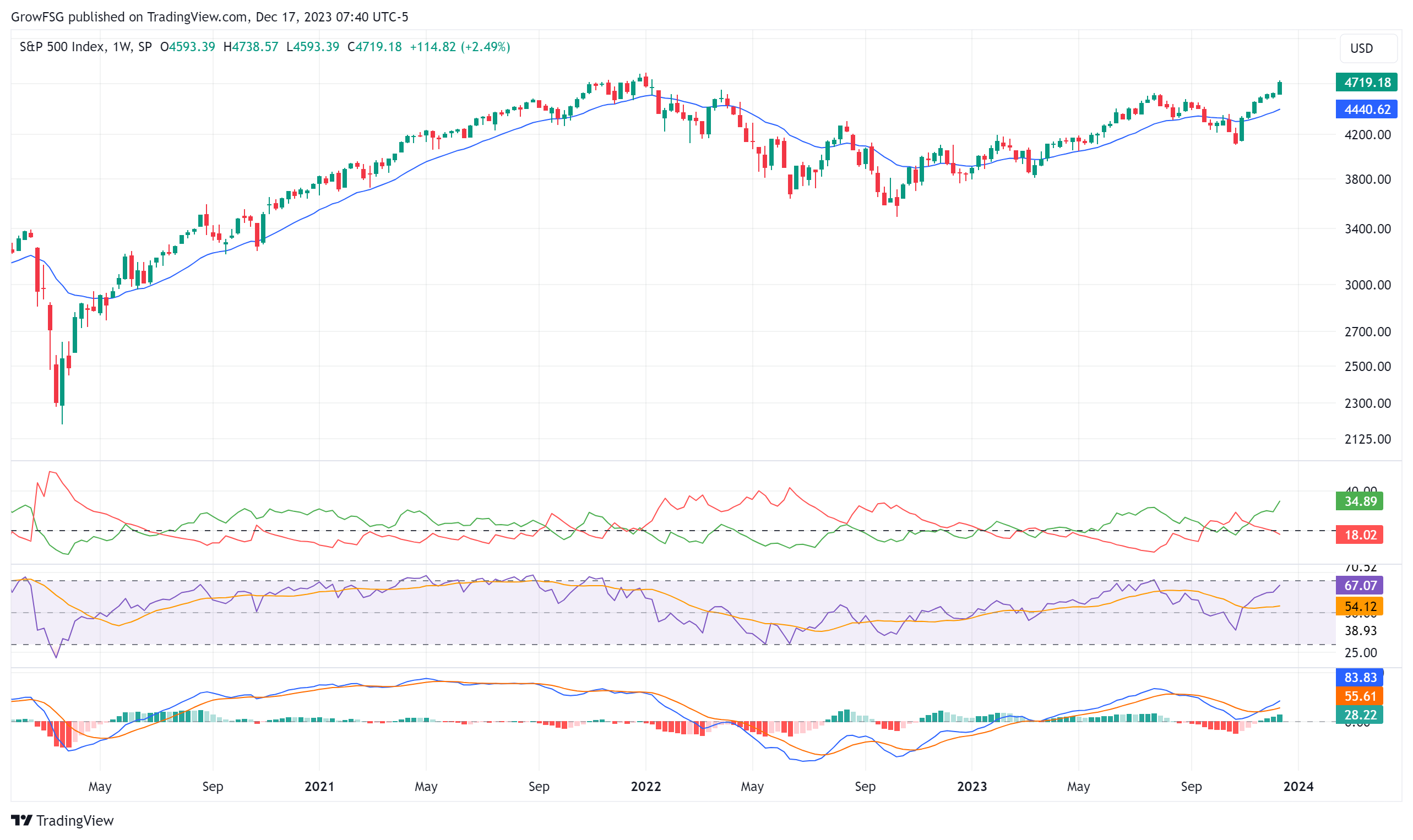

On a weekly basis, the C fund looks to be breaking out of a classic Cup & Handle pattern. This is extremely bullish. What's really encouraging is the red ADX line is below 20 and falling. Sellers of the S&P are leaving the market. RSI is not yet overbought and MACD has only been positive for 4 weeks. There is certainly more upside potential in this chart.

On a daily basis, the C fund is extremely overextended and due for a pull back. The support range shown is most likely. Ideally, a pull back to the upper support level which intersects the 20DMA. A daily close below the lower support channel would be a serious red flag. From Friday's close, a pull back to the 20DMA is almost 3%.

On a weekly basis, the S fund broke out of its long term consolidation pattern this week. The bullish case for stocks in 2024 is for the broader market to catch up to the outperformance that we have seen in the S&P, lead by the Magnificent 7, in 2023. With this breakout in the S fund, it looks like that's exactly what's happening. For now, it's very bullish. If the S fund rolls over and closes back within the consolidation range, the breakout would have failed.

On a daily basis, the S fund is extremely overextended. A pull back to its 20DMA would be almost a 6.5% drawdown from Friday's close.

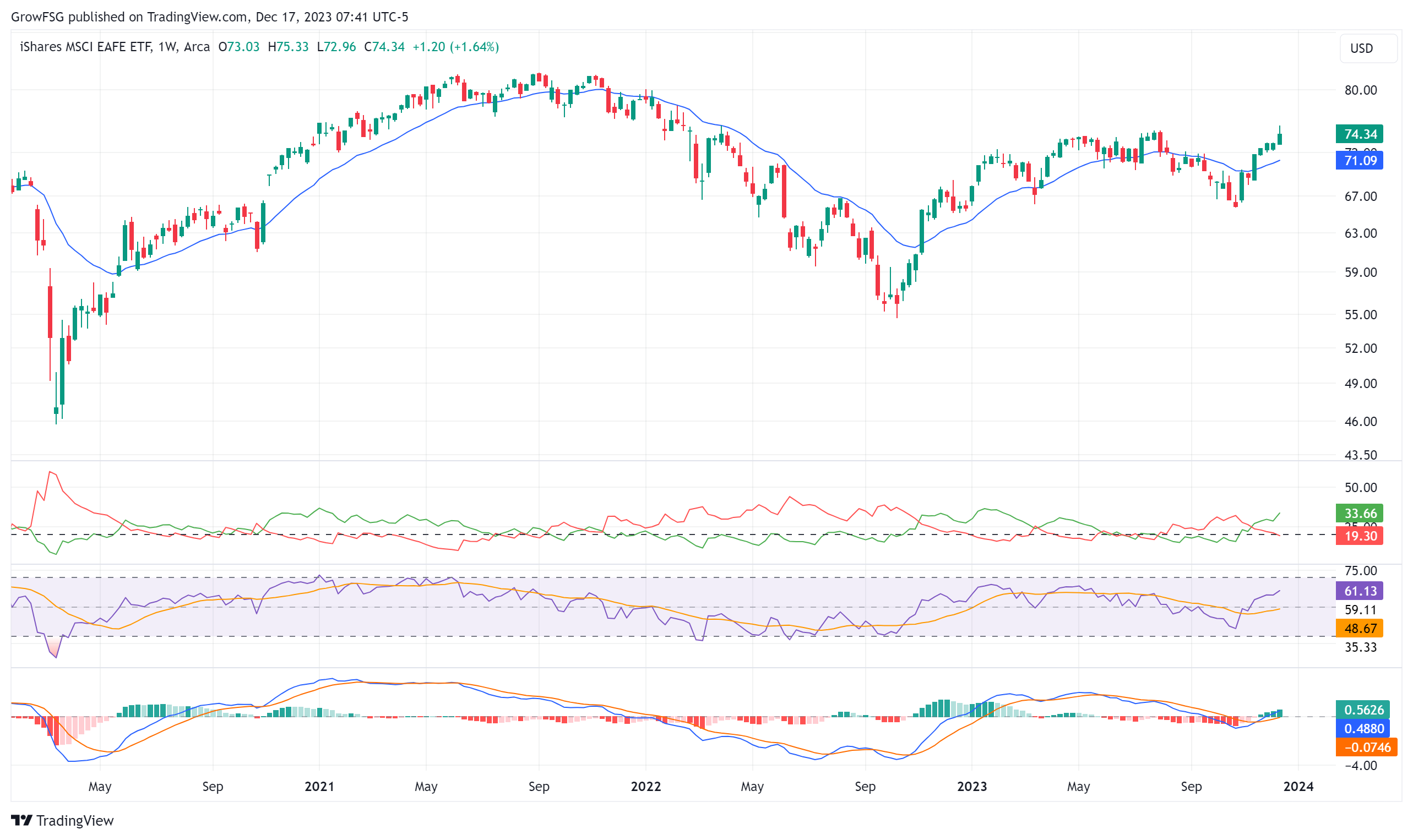

The I fund chart also looks strong on a weekly basis. Buyers, the green ADX line, are coming into the market, RSI has plenty of room to move higher, and MACD has only been positive for the past 4 weeks. Friday's pull back was commensurate with the daily move higher in the dollar.

The F fund looks extremely strong on a weekly basis. Buyers are coming into the market as sellers are leaving (ADX lines). RSI has room to move higher. We have been anticipating this rally for months and it has the potential to move much higher, depending on rate cuts in 2024.

The FED flipped this week. The rate hike cycle is over. The question is when and how many times the FED drops rates in 2024. This is a monster tailwind for stocks and bonds. What we need to watch is how the economy responds, particularly unemployment and banks.

In the short-term, we could see a pull back which would actually be healthy at this point. In the longer term, into the first quarter of 2024, the rally most likely continues.

Have a great week!

The Grow My TSP Team

No one has a crystal ball and everyone has an opinion. The best we can do as TSP investors is to seek out the most diverse opinions from the most reputable sources. This way we can understand the range of possibilities and be prepared to respond to what the market actually does.

Last week's Newsletter focused on a recent CNBC interview with Tom Lee @FundStrat. Tom is very bullish on 2024 and clearly articulates why in this interview. This week we're taking a close look at a recent interview between Adam Taggart at the YouTube channel Thoughtful Money, and Swiss financier Felix Zulauf. Felix has a very different take on price action in 2024 versus Tom. Here's his bio from Wikipedia:

"Felix W. Zulauf is a Swiss hedge fund manager and former banking executive who founded Zulauf Asset Management, a Zug, Switzerland-based hedge fund founded in 1990 with over $1.7 billion in assets under management according to MacroAxis. Zulauf has been a regular member of the Barron's Roundtable for almost 30 years." Wikipedia

He brings a European prospective. You may not agree with his views throughout the video but, his long-term success as a money manger (not a talking head) is extremely valuable. Here's a summary of important takeaways from the video:

- "Decade of the roller coasters" where markets will rise and fall dramatically as the natural forces of deflation battle it out with the rescue efforts of the central planners.

- From here, he anticipates the stock market recovery to be short-lived, attributing it to the Federal Reserve's excessive easing, leading to a mini bull cycle that will power stocks to new highs by Q1 2024.

- But then, the lag effect will take over. The concentrated portfolio in a few stocks, particularly the Magnificent 7 stocks, could lead to a substantial market decline, potentially reaching the low 3,000s in the S&P in late summer 2024.

- This decline may trigger a recession, prompting authorities to inject liquidity and stimulate the economy, resulting in a market rebound and new highs in 2025-2026. However, a significant inflationary wave in 2025 to 2026, exceeding 10%, may create challenges for the bond market and trigger another downturn in the stock market. This is why Felix refers to this as the decade of the roller coaster.

- Opportunities: 1. Recognize opportunities to short equities. 2. Capitalize on short term decline in bond yields. 3. Be ready to go long when S&P gets oversold at/near 3,000.

- Felix advises navigating volatility by staying on the right side of mini cycles, cautioning passive investors about potential disappointment in returns.

TSP Fund Charts

It was a very strong week for the market, and the S fund in particular. What's going to be difficult for some TSP investors going forward is reconciling the weekly vs daily charts. All 4 of the core TSP funds are extremely overextended on a daily basis. These extreme levels will correct eventually. On a weekly basis, the charts look very strong with plenty of room to move higher before becoming overbought. We are in a bull market so, pull backs to reasonable support levels are healthy and represent opportunities to "buy the dip". The concern for some TSP investors is that these pull backs could be significant on a percentage basis.On a weekly basis, the C fund looks to be breaking out of a classic Cup & Handle pattern. This is extremely bullish. What's really encouraging is the red ADX line is below 20 and falling. Sellers of the S&P are leaving the market. RSI is not yet overbought and MACD has only been positive for 4 weeks. There is certainly more upside potential in this chart.

On a daily basis, the C fund is extremely overextended and due for a pull back. The support range shown is most likely. Ideally, a pull back to the upper support level which intersects the 20DMA. A daily close below the lower support channel would be a serious red flag. From Friday's close, a pull back to the 20DMA is almost 3%.

On a weekly basis, the S fund broke out of its long term consolidation pattern this week. The bullish case for stocks in 2024 is for the broader market to catch up to the outperformance that we have seen in the S&P, lead by the Magnificent 7, in 2023. With this breakout in the S fund, it looks like that's exactly what's happening. For now, it's very bullish. If the S fund rolls over and closes back within the consolidation range, the breakout would have failed.

On a daily basis, the S fund is extremely overextended. A pull back to its 20DMA would be almost a 6.5% drawdown from Friday's close.

The I fund chart also looks strong on a weekly basis. Buyers, the green ADX line, are coming into the market, RSI has plenty of room to move higher, and MACD has only been positive for the past 4 weeks. Friday's pull back was commensurate with the daily move higher in the dollar.

The F fund looks extremely strong on a weekly basis. Buyers are coming into the market as sellers are leaving (ADX lines). RSI has room to move higher. We have been anticipating this rally for months and it has the potential to move much higher, depending on rate cuts in 2024.

Bottom Line

While Tom Lee and Felix Zulauf have very different long term forecasts, they clearly overlap into the first quarter of next year. In fact, the vast majority of generally bullish and generally bearish analysts are on the same page for the next couple of months. All bullish.The FED flipped this week. The rate hike cycle is over. The question is when and how many times the FED drops rates in 2024. This is a monster tailwind for stocks and bonds. What we need to watch is how the economy responds, particularly unemployment and banks.

In the short-term, we could see a pull back which would actually be healthy at this point. In the longer term, into the first quarter of 2024, the rally most likely continues.

Have a great week!

The Grow My TSP Team

RELATED READS

Copyright Grow Investments, LLC | GrowMyTSP.com

Thrift Savings Plan Disclaimer

Neither growmytsp.com nor any of its partners or representatives is in any way affiliated with the United States Government, The Federal Retirement Thrift Investment Board (FRTIB.gov) or the Thrift Savings Plan (TSP.gov), and any service being offered is not sanctioned by the United States Government, the Federal Retirement Thrift Investment Board or the Thrift Savings Plan.